Month-to-month Replace #59 (July 2023) – Pivot, Pivot, Pivot! – Complete Steadiness – Cyber Tech

Hiya folks!

It’s time for an additional riveting replace from yours actually. As is the norm as of late, there was a improvement that has flipped all the things the other way up.

On July thirty first we handed over the keys to our previous dwelling to its new homeowners. We’re now formally residing IN the brand new home.

We had been speculated to be residing IN the non permanent “trailer” dwelling within the again yard – however we’re not…

All of it started on July 28. It was a Friday, and we had been trying ahead to get our new non permanent dwelling put in – and to get settled in. We had been handing over the keys to our previous home on Monday thirty first, so we solely had 3 days to maneuver all the things and settle in.

The “tiny-house” arrived on time and was craned into our yard. It didn’t take them lengthy to “set up it”.

It took up fairly some house within the backyard – nearly all of it, truly!

My spouse walked inside the brand new residing association and shortly after she uttered the well-known phrases: “Proper, I’m not sleeping on this”…

*Face palm*

The room the place our daughter was speculated to sleep in had clear indications of black mould! Granted, this unit was a bit older than we had hoped and since black mould is a fairly extreme security hazard there was just one factor to do; Transfer into the home as a substitute!

Thoughts you that we had not meant to reside in the home at this level, however because the precise renovations hasn’t began but – it was/is livable. It simply doesn’t have a kitchen, and there may be furnishings and packing containers in every single place…

Anyway, just a few hours later – some speed-cleaning and transferring stuff round, we had a bed room that we might sleep in. We after all referred to as the “tiny home” firm, which stated they might ship a “cleansing crew” very first thing on Monday. The factor with black mould is, as soon as it’s been there it’s not that straightforward to take away – and it can’t be carried out by customary cleansing merchandise, so we demanded that they despatched us a brand new mold-free unit. We agreed that we’d allow them to try to wash it, after which we’d have it examined for black mould afterwards.

Now, I ought to state that earlier than all this occurred, I had truly begged and pleaded with the spouse to truly CANCEL the tiny-home and transfer into the home as a substitute – because it was THERE. Initially we had anticipated to be mid-renovation at this level, and thus we’d haven’t been capable of reside inside the home. However as a result of the renovation is paused (due to the continuing insurance coverage case) the home was/is definitely livable. BUT, at this level my spouse didn’t wish to transfer into the home, however would slightly that we adopted our unique plan with the tiny dwelling…

Alas, the universe wished it in any other case, and I distinctly keep in mind my spouse uttering the next phrases on that day: “You had been proper all alongside, honey- we must always have cancelled that rattling factor and simply moved into the home as a substitute”. YOU READ IT HERE FIRST, FOLKS! I WAS RIGHT ALL ALONG! 😛

Anyway, we had the tiny-home examined for black mould (so now we will add this to our ever-growing resumé of shit we now know the best way to do!), and positive sufficient – it had “extreme black mould progress”. Ouch. The corporate then determined to take away it once more AND stated that they may not promise us {that a} new one would NOT have black mould in it! OMG! So they may refund us the cash after which I suppose we live in our new home for now!…

I then scoured the phone book for kitchen cupboards and home equipment, and we have now now constructed a fairly well-functioning kitchen for lower than €500. And that is the place it turns into fairly fascinating. We’ve now been residing in a home for about 14 days that has each fundamental performance {that a} home wants – and but we’re planning to MOVE out of it (sooner or later) to tear all of it aside, and set up a brand new €10,000+ kitchen (amongst different issues). However why? It really works simply high-quality the way in which it’s. Granted, it’s not fairly – nevertheless it works! Sadly my psychological state and my spouse’s appear to have gone in reverse instructions right here. I’m now questioning this complete renovation ordeal, whereas she will’t wait to get it again on monitor. However the place will we then reside?! At this level, we don’t actually know…However as at all times, I’m positive we are going to determine it out ultimately. I put my religion within the universe as soon as once more! 😉

The scenario has spurred some stress in our family… I’m making an attempt to see issues from either side, however regardless of how I take a look at it, it appears frivolous to spend €100,000+ renovating a house that isn’t defective per say. – It’s simply outdated and a bit obscure 😛

I’m making ready mentally to spend the winter in our non permanent residing scenario, whereas my spouse is on the cellphone with the insurance coverage firm day by day, making an attempt to get them to hurry up the method. I feel she’s battling a misplaced trigger right here although. There isn’t a treatment for forms and short-staffed insurance coverage firms. You simply should be affected person – and whereas traditionally endurance hasn’t been my sturdy go well with, I’m SO ready to attend this one out! HAHA. Apparently I’m far more prepared to reside in “non permanent lodging” as a result of I do know that it’s non permanent. Definitely there are folks on the market on the planet, who’re residing in a lot worse PERMANENT residing circumstances than we’re. My spouse then again, is NOT blissful…And you realize what they are saying; Glad spouse, blissful life. In order you possibly can think about, at the moment sad spouse = sad life…

On the plus aspect of all of this, our month-to-month bills have now settled considerably (since our mortgage on the previous home has now been settled) and we will now already begin to see among the financial savings that we are going to be reaping each month. Most of those financial savings will go in direction of amortization although – which suggests it will likely be reworked to fairness. Simply to re-cap for these of you who aren’t on top of things with what’s occurring; We moved to a smaller and cheaper dwelling for 2 causes:

- To get nearer to our daughters college so she might stroll to/from college

- To decrease our month-to-month bills (to have the ability to save extra in direction of FIRE)

From day 1 within the new home we’ve been reaping the advantages of #1 motive. Our daughter has been strolling to and from college day by day – and she or he loves it. The liberty that it provides not solely her, but in addition her mother and father is priceless! 🙂 As a result of our site visitors patterns have modified drastically, we consider we will reside with having just one automotive (please, there are folks on the market residing with 0 vehicles! 😛 ), so this would be the subsequent step of the journey. Subsequent month our lease is up on our little EV (Renault Zoe). I’m discovering it onerous to say goodbye to this little trooper. It’s not fairly or quick, nevertheless it will get the job carried out! It’s quiet and really economical. Not like our soon-to-be solely automotive, our 10-year previous Skoda Fast…It’s not quiet and it runs on gasoline…*deep breaths*. We purchased it 2nd hand 6 years in the past, and it has been very reliable. However because it ages (near reaching 200,000km now) it’s going to want an increasing number of repairs. It’s one factor going from having two vehicles to 1 – I feel that shall be doable for us. The weary feeling that I’ve about this, is that I don’t just like the 1 automotive we have now left. It’s my spouse’s automotive, and I don’t like driving it. But it surely’s low-cost (till the main repairs begin to arrive!). I don’t know guys, I really feel like a substitute is imminent, though given my rant above about being OK residing in an previous home, why wouldn’t I be OK with driving an previous automotive?…I simply hope it’ll get via the winter with none main hiccups 😛 – As a result of on the first signal of issues with that automotive, I predict it will likely be changed! HAHA.

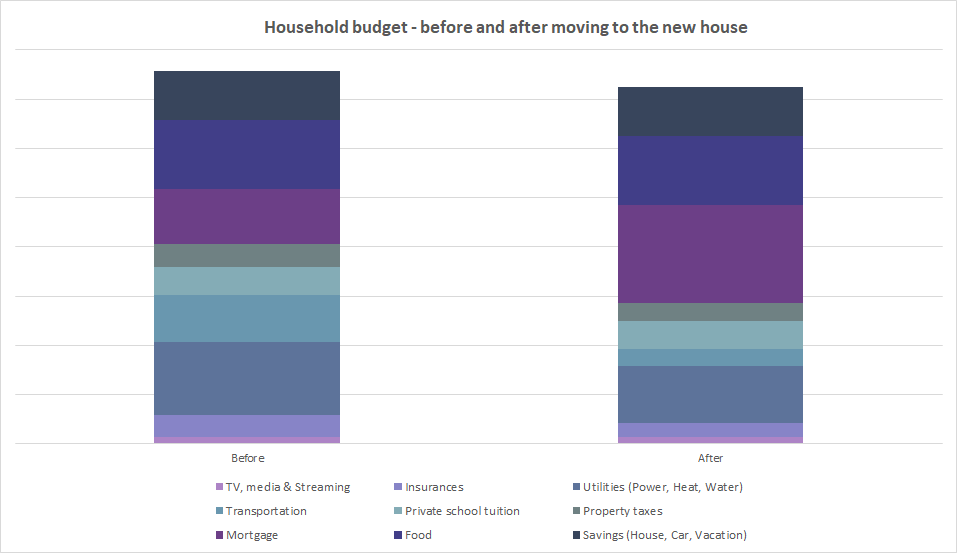

Anyway, the #2 motive for transferring was reducing our month-to-month (residing) bills. We had been on monitor for a 30% lower in direct residing bills – however then this shit occurred:

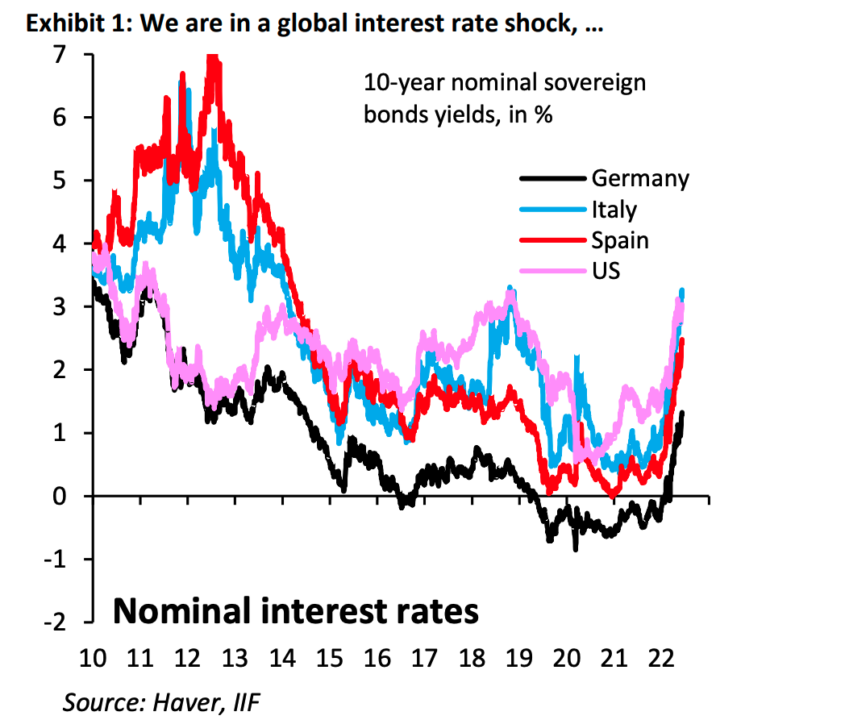

Whereas our new mortgage is definitely 40% smaller than our previous one, the rate of interest is 350% larger! Yikes! So we determined to return to amortization on the brand new mortgage. Which means that our total funds solely decreased by 4% from the previous home to the brand new home – however, we weren’t amortizing within the previous home with the previous mortgage, so an enormous chunk of the brand new funds is clearly going to be became dwelling fairness. We are going to proceed to do that so long as the rate of interest stay on the present ranges. Ought to it as soon as once more return to ~1-2%, we are going to most likely cease amortizing and prioritize investing as a substitute.

That is our new funds in comparison with the previous one:

I’m clinging to the truth that it IS nonetheless (barely) cheaper within the new home…Sadly, total this isn’t going to get us nearer to our Complete Steadiness objective any sooner…It’s again to the drafting board on that one, I suppose!

However that is when it begins to get slightly licorice (it’s a Danish expression. – It means: now it’s getting fascinating/thrilling/thrilling/nerve wrecking). Keep in mind once I stated that our new mortgage was 40% smaller than our previous one? A number of the distinction is at the moment now in our checking account. This quantities to round €100,000 truly, which occurs to be our renovation funds (shock, shock). For those who keep in mind, I’ve been transferring my money stash round between whichever financial institution was paying the best curiosity. These days this has been both Norwegian Financial institution og Santander. They each at the moment pay 2.10%. However I’ve simply found that our fundamental dealer (Saxo Financial institution) is at the moment providing 2.8% on deposits above €90,000. Which means that our renovation funds is at the moment producing simply shy of €8/day in curiosity in the intervening time. That’s €240/month. That is after all not a fortune, nevertheless it interprets to nearly €3,000/12 months. This sum of money might truly finance a small automotive…So that is the place we’re at; Do I desire a new kitchen/new toilet/new lounge/new bed room/new driveway/you-get-the-idea or do I desire a new automotive?!…Choices, choices…

So long as we aren’t contributing to our Complete Steadiness, I don’t suppose it is sensible to maintain updating this chart (additionally, I’m very lazy). We’ve got began dipping into the money stash to help our loopy constructing challenge, so I’ll briefly retire the Traditional progress chart from the month-to-month replace for now… (It shall return!).

We are actually residing inside our renovation challenge, as a result of the tiny dwelling was contaminated by black mould. YAY!

For the reason that precise renovations hasn’t began but (as a result of we’re awaiting the end result of an ongoing insurance coverage case) the home is livable, albeit a bit funky…

I’m surprisingly comfy with the entire scenario, albeit my spouse is NOT. So naturally, none of us are blissful proper now! 😛

Nicely, I’m sort of blissful, as a result of our renovation funds is at the moment yielding a cool 2.8% curiosity within the financial institution (give me a break, I’ve to have one thing that I might be thrilled about! I do know that 2.8% isn’t lots, however thoughts you that 2 years in the past we had been truly PAYING 0.60% to have cash within the financial institution!).

See you subsequent month!