Finland’s proposed labour reforms threat doing extra hurt than good – Cyber Tech

Strikes have taken place in Finland towards proposed labour reforms. Markku Sippola argues Finland’s present financial state of affairs gives little justification for the reforms, which may have a big influence on employees and the financial system.

The Finnish authorities, led by Petteri Orpo, is at present implementing sweeping labour and social safety reforms. These have been justified as a approach to enhance employment and competitiveness, however with out real session with commerce unions.

The modifications embrace making it simpler to dismiss workers, enjoyable rules on fixed-term contracts, making the primary sick day a day with out pay, decreasing unemployment advantages, proscribing political strikes, capping wage will increase primarily based on export sector wages and easing native bargaining. The unprecedented scale of change is harking back to the reforms pursued by Margaret Thatcher within the UK or by Portugal beneath strain from the Troika in 2011. Nevertheless, not like these conditions, Finland’s financial state of affairs doesn’t necessitate such reforms.

The reforms have sparked huge strikes from Finnish commerce unions, but the federal government stays steadfast. This implies a deliberate try and weaken union energy. The federal government argues that the prevailing labour market buildings have led to poor financial outcomes, with Finland having excessive unionisation charges and powerful collective agreements.

Whereas Finland has maintained low in-work poverty charges due to its centralised wage-setting system, employer associations see the latter as market rigidity. The federal government goals to not solely scale back social safety protections briefly but additionally dismantle decades-long industrial relations buildings.

Proposed modifications embrace permitting non-union representatives for native bargaining, limiting political strikes, growing penalties for participation in “unlawful” strikes and decreasing the nationwide conciliator’s energy to suggest sector-level wage will increase. These modifications intention to undermine union legitimacy, discourage industrial actions and weaken the nationwide conciliator’s function.

How dangerous is the financial state of affairs in Finland?

The financial state of affairs in Finland is just not as catastrophic as through the COVID-19 disaster. And whereas the federal government claims its reforms will enhance competitiveness and employment, proof is missing. Present productiveness and employment charges are average, and authorities debt, whereas rising, is just not alarming (Desk 1). The federal government has reacted to a rising funds deficit by chopping each taxes and social safety, thus eroding the tax base.

Desk 1: Key indicators for the Finnish financial system in comparison with chosen OECD international locations

Observe: All figures from 2022. Sources: GDP per capita: World Financial institution; Debt to GDP ratio: World Inhabitants Evaluation; GDP per hour labored: OECD; Employment price: OECD.

In the course of the COVID-19 disaster, a tripartite effort, involving the federal government, employer associations and commerce unions, helped mitigate financial misery. Nevertheless, the present authorities is unilaterally pushing labour market reforms with out significant dialogue. Comparisons with previous European reforms counsel potential penalties for Finnish competitiveness and employment and will increase considerations in regards to the future influence on employees and unions.

Classes from the UK and Portugal

The present strikes in Finland have parallels with the UK’s “winter of discontent” through the Nineteen Seventies, which led to Margaret Thatcher’s rise to energy. Thatcher applied stringent measures towards unions, halving membership by the flip of the century. Her robust stance, epitomised by the 1984-1985 miners’ strike, earned her the nickname the “Iron Girl”. Whereas her reforms barely improved productiveness and decreased inflation, they exacerbated inequalities and had minimal influence on unemployment.

Equally, the Finnish authorities views unions as a menace to democracy and is imposing labour reforms that weren’t contained within the marketing campaign pledges made by the governing events on the final election in 2023. The federal government additionally plans to tremendous people and unions for taking part in “illegal” strikes, which have been additionally a spotlight of Thatcher’s insurance policies.

Portugal applied reforms that have been overseen by the Troika within the 2010s as a consequence of a fiscal imbalance and financial stagnation. These reforms included labour market modifications like decreased severance funds and elevated flexibility. Regardless of preliminary optimistic financial indicators, the reforms extended the nation’s recession and deregulated labour markets. Nevertheless, after left-wing events took energy in 2015, the financial system started to recuperate steadily with extra pro-labour insurance policies.

Whereas initially profitable, the Troika reforms did little to spice up Portugal’s financial system in the long term. As an alternative, returning to collective bargaining and prioritising well-protected employment since 2015 proved extra helpful. Although unionisation charges dropped, post-Troika Portugal reveals how labour-hostile insurance policies may be reversed for extra optimistic financial and employment outcomes. This parallels the arguments behind Finland’s present labour reforms, though the outcomes differ considerably.

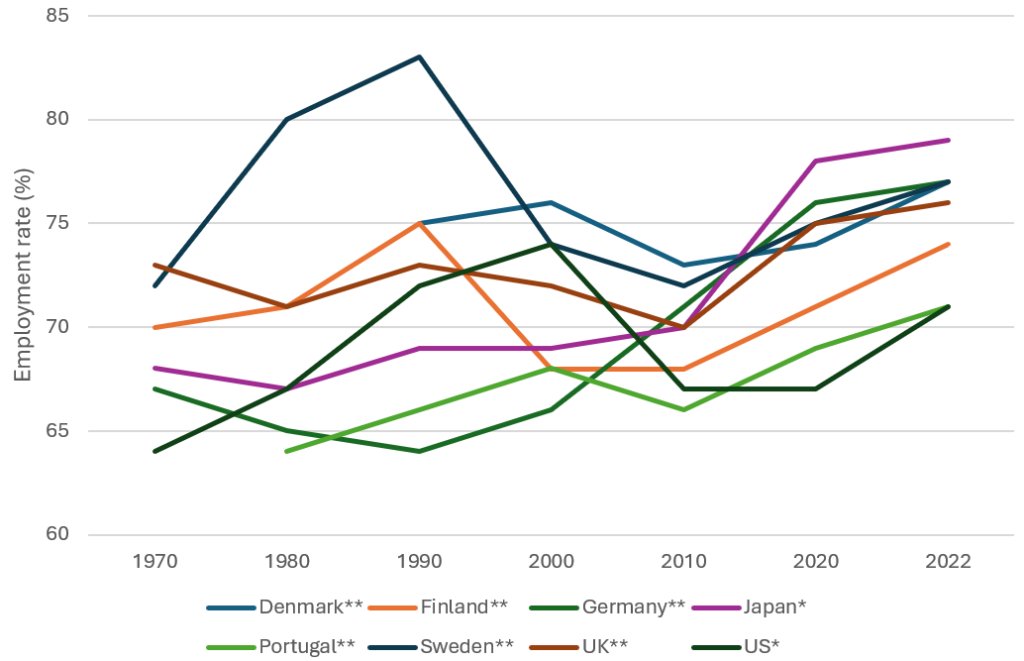

Employment and productiveness traits don’t present exceptional efficiency outcomes for the UK and Portugal throughout their respective reforms. As Determine 1 reveals, Portugal has made vital progress on employment charges, however nonetheless lags behind the UK and Finland.

Determine 1: Employment price in chosen OECD international locations

Observe: OECD information for individuals aged 15-64.

Thatcher’s insurance policies within the UK through the Nineteen Eighties didn’t notably enhance the employment price. Sweden outperformed all international locations within the Nineteen Eighties, whereas Finland’s employment price plummeted through the Nineties recession, however has since rebounded. Latest employment price will increase in Japan, Germany and the UK are attributed to the proliferation of low-paid jobs, resulting in an increase in in-work poverty.

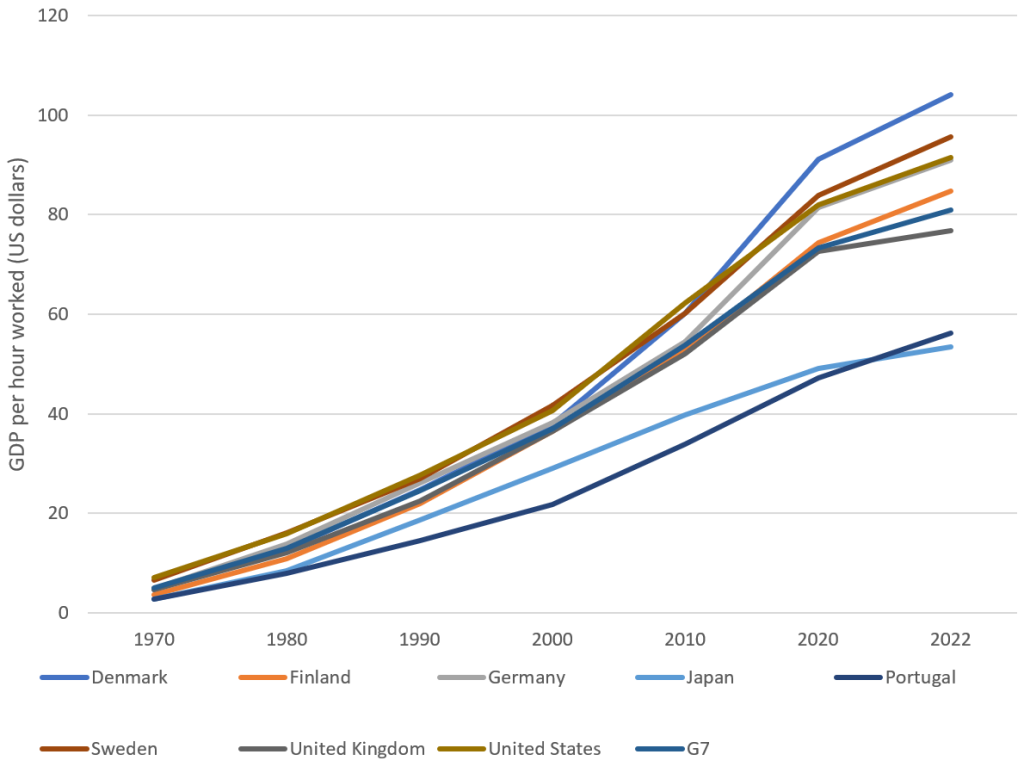

An analogous image emerges in relation to productiveness. Productiveness in Finland and the UK have adopted related trajectories since 1970, with Finland barely outpacing the UK in recent times. Portugal’s productiveness remained stagnant regardless of the Troika reforms from 2010 to 2014, as proven in Determine 2.

Determine 2: GDP per hour labored in chosen OECD international locations

Observe: Figures are in US {dollars} (present costs). Information from OECD.

The above comparability reveals the Finnish authorities’s proposed labour and industrial relations reforms are unsustainable. Finland’s productiveness and employment charges are already secure, negating the necessity for drastic measures. Analogous reforms within the UK and Portugal, pushed by home and worldwide pressures respectively, didn’t notably enhance financial outcomes. Portugal noticed some progress post-Troika reforms, whereas the UK’s employment improve was pushed by an increase in low-paid jobs.

The federal government’s unilateral “shock-therapy” undermines unions and diverges from the gradual reform strategy taken by neighbouring Nordic international locations, the place reforms contain labour market stakeholders. This unilateral assault on unions dangers destabilising Finland’s comparatively sturdy financial indicators, together with low in-work poverty charges.

Observe: This text offers the views of the creator, not the place of EUROPP – European Politics and Coverage or the London College of Economics. Featured picture credit score: Alexandros Michailidis / Shutterstock.com