Apple Ought to Make Higher Selections To Guarantee Their Wonderful Enterprise Continues (AAPL) – Cyber Tech

ozgurdonmaz

Introduction

The Justice Division filed a criticism in opposition to Apple (NASDAQ:AAPL) on March 21, 2024. It clearly exhibits Apple has a superb enterprise. The authorized system will resolve what it exhibits with respect to antitrust violations. My thesis is that Apple ought to make higher choices shifting ahead with the intention to prolong the sturdiness of their enterprise.

Apple’s fiscal yr goes via the final Saturday of September.

Monetary Concerns

The numbers for Apple from the final 5 years present they’ve a superb enterprise ($ in tens of millions besides Primary EPS):

|

Primary EPS |

Internet earnings |

Internet margin |

FCF |

Working earnings |

Gross revenue |

Gross margin |

Gross sales |

|

|

FY19 |

$2.99 |

$55,256 |

21% |

$58,896 |

$63,930 |

$98,392 |

38% |

$260,174 |

|

FY20 |

$3.31 |

$57,411 |

21% |

$73,365 |

$66,288 |

$104,956 |

38% |

$274,515 |

|

FY21 |

$5.67 |

$94,680 |

26% |

$92,953 |

$108,949 |

$152,836 |

42% |

$365,817 |

|

FY22 |

$6.15 |

$99,803 |

25% |

$111,443 |

$119,437 |

$170,782 |

43% |

$394,328 |

|

FY23 |

$6.16 |

$96,995 |

25% |

$99,584 |

$114,301 |

$169,148 |

44% |

$383,285 |

Many different corporations on the market would relish the considered greater than doubling EPS in 4 years whereas having a margin which is 1/4th of gross sales.

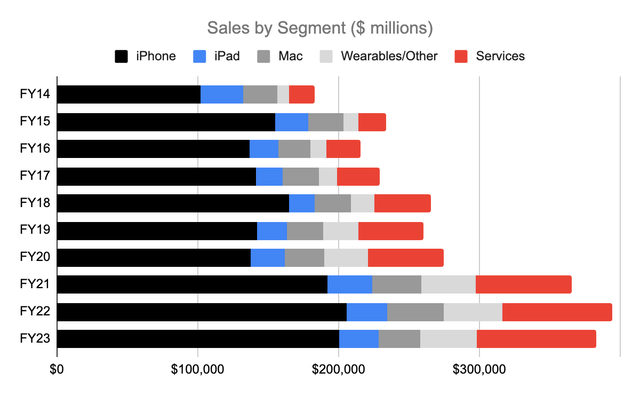

Section Gross sales

You will need to put the gross sales segments in perspective earlier than going via the explanations as to why Apple is such an amazing enterprise and why they should make higher choices in sure areas. The Wearables/Different section elevated from 4.6% of income in FY14 to 10.4% in FY23. The Providers section has additionally elevated over time, going from 9.9% of income in FY14 to 22.2% in FY23. These segments couldn’t be extra totally different. The Wearables section is necessary not just for the direct income it brings but in addition as a result of it encourages individuals to remain within the iPhone ecosystem. The Justice Division criticism spells this out (emphasis added):

In a 2019 e mail the Vice President of Product Advertising for Apple Watch acknowledged that Apple Watch “could assist stop iPhone clients from switching.” Surveys have reached comparable conclusions: many customers say the different gadgets linked to their iPhone are the explanation they don’t change to Android.

Apple is grasping with the Providers section and this causes resentment from everybody together with antitrust accusations from the federal government.

Wanting on the final 10 years, the Wearables/Different section has grown prodigiously from gross sales of $8.4 billion in fiscal 2014 to gross sales of $39.8 billion in fiscal 2023:

Section gross sales (Creator’s spreadsheet from 10-Ok filings)

The iPad section has shrunk just a little bit and the Mac section has been pretty flat. The Wearables section above has a 9-year CAGR of 18.9%. The Providers CAGR can also be proper up there at 18.8% however once more, the EU and the US Justice Division are taking actions which put this section in jeopardy.

Apple’s Wonderful Enterprise

The Justice Division criticism is loaded with particulars concerning the benefits Apple enjoys. Apple and Samsung (OTCPK:SSNLF) dominate the US smartphone {hardware} market and Google (GOOG) (GOOGL) is a distant third. 90% of the smartphone income within the US goes to Apple and Samsung. Historical past has proven important boundaries to entry within the US smartphone market. Lower than 10% of smartphone purchases within the US are from clients shopping for their very first smartphone. As such, it’s onerous for newcomers to get a foothold as a result of current Apple and Samsung clients will be reluctant to strive one thing which isn’t established. Amazon (AMZN) failed to achieve traction with their Fireplace cell phone in 2014. Microsoft (MSFT) gave up on their cellular efforts in 2017. HTC exited the area by promoting their enterprise to Google in 2017. LG left the market in 2021.

Ever for the reason that iPhone got here out, Apple has constructed and sustained essentially the most dominant smartphone platform and ecosystem within the US and Apple is on the excessive finish of the smartphone market relative to Samsung. The Justice Division criticism refers back to the excessive finish of the market because the efficiency market and it says Apple’s US share is over 70%. The criticism says iPhone machine revenue margins are greater than 30% that are greater than the odds we see from Samsung. The Justice Division criticism discusses specifics (emphasis added):

Apple’s per-unit smartphone revenue margins are way over its subsequent most worthwhile rival. Apple fees carriers significantly greater than its rivals to purchase and resell its smartphones to the general public and employs contract clauses that will impede the flexibility of carriers to advertise rival smartphones.

Apple’s dominance within the US ought to proceed for a very long time seeing as 1/third of all US iPhone customers had been born after 1996 whereas that is solely true for 10% of Samsung customers. Apple has essentially the most younger customers with many future purchases forward and nearly 90% of US iPhone house owners select one other iPhone as their subsequent smartphone buy. Apple has pricing energy. The unique iPhone with a two-year cellphone service contract had a value of about $450 in 2024 {dollars} adjusted for inflation however immediately’s fashions can promote for a lot extra – as much as $1,599.

Higher Selections Transferring Ahead

This a part of the Justice Division criticism highlights Apple’s shaky choices and I agree their decisions have been lower than optimum (emphasis added):

Limiting the options and performance created by third-party builders – and due to this fact out there to iPhone customers – makes the iPhone worse and deprives Apple of the financial worth it will achieve because the platform operator. It makes no financial sense for Apple to sacrifice the earnings it will earn from new options and performance.

Apple’s determination to make issues tough for Spotify (SPOT) over time has induced resentment. Their Apple Music product ought to compete by itself advantage and never be given unfair therapy. Spotify’s Time To Play Honest Timeline highlights controversial choices made by Apple over time. Apple got here out with the watch in April 2015 and so they knew Apple Music could be out there a couple of months later. As such, they didn’t permit Spotify to make a watch app:

Spotify denied (Spotify’s Time To Play Honest Timeline)

Apple made short-sighted choices in rejecting Spotify’s innovation efforts. The Justice Division criticism explains how Apple has a historical past of doing this by abusing the “app evaluate” course of and denying entry to APIs:

Spotify rejections (Spotify’s Time To Play Honest Timeline)

Anybody who has frolicked in China in the previous couple of years is aware of the US is behind by way of the best way smartphones are used. A part of the explanation for it is because Apple has made the dangerous determination to stifle the forms of issues which will be performed with tremendous apps. Within the US we will’t even purchase a Kindle ebook from the iPhone as a result of Apple has determined to be grasping about amassing a tax from Amazon. A June 2020 WSJ article discusses this problem and different issues with restrictions due to Apple’s choices to be rapacious with their tax. The Justice Division criticism spells out specifics on the extent of the tax:

For a lot of the final 15 years, Apple collected a tax within the type of a 30 % fee on the worth of any app downloaded from the App Retailer, a 30 % tax on in-app purchases, and charges to entry the instruments wanted to develop iPhone native apps within the first place. Whereas Apple has decreased the tax it collects from a subset of builders, Apple nonetheless extracts 30 % from many app makers.

Tencent’s (OTCPK:TCEHY) WeChat is an excellent app which permits customers in China to make use of their smartphones extra effectively with parking heaps, toll roads, menu looking, restaurant funds, reservations, appointments, subway fares and different issues. Prior to now Apple has anxious about customers being loyal to the model if tremendous apps can do all the pieces from any sort of cellphone. That is much less of a difficulty now that we’ve got customers absolutely taking part within the ecosystem with a cellphone, a watch and AirPods. Customers are keen to pay extra for a seamless ecosystem with these merchandise and it’s now time for Apple to be extra open-minded with choices tied to tremendous apps. The Justice Division criticism explains how Apple made dangerous choices on this space prior to now:

Apple has used one or each mechanisms (management of app distribution or management of APIs) to suppress the next applied sciences, amongst others: Tremendous apps present a consumer with broad performance in a single app. Tremendous apps can enhance smartphone competitors by offering a constant consumer expertise that may be ported throughout gadgets. Suppressing tremendous apps harms all smartphone customers – together with Apple customers – by denying them entry to prime quality experiences and it harms builders by stopping them from innovating and promoting merchandise.

Apple markets themselves as an organization which prioritizes privateness and restricts intrusive advertisements. The Justice Division criticism highlights the hypocrisy and greed concerned within the Apple determination making course of after they cost a big tax for apps after which cost for key phrase promoting on prime of this (emphasis added):

Apple additionally generates substantial and rising income by charging builders to assist customers discover their apps within the App Retailer – one thing that, for years, Apple informed builders was a part of the explanation they paid a 30 % tax within the first place. For instance, Apple will promote key phrase searches for an app to somebody apart from the proprietor of the app. Apple is ready to command these rents from corporations of all sizes, together with among the largest and most subtle corporations on this planet.

The Justice Division criticism goes on to say Apple is extra restrictive than mandatory with the iPhone whereas they’re extra cheap with the Mac. Transferring ahead, I believe Apple ought to make higher choices by way of making the iPhone extra open just like the Mac (emphasis added):

As some extent of comparability, Apple doesn’t interact in such conduct on its Mac laptops and computer systems. It provides builders the liberty to distribute software program on to customers on Mac with out going via an Apple-controlled app retailer and with out paying Apple app retailer charges. This nonetheless gives a secure and safe expertise for Mac customers, demonstrating that Apple’s management over app distribution and creation on the iPhone is considerably extra restrictive than mandatory to guard consumer privateness and safety.

Per the NY Instances, Apple spent greater than $10 billion on their automotive venture which they’ve since deserted. Transferring ahead, they need to take into consideration smarter choices with aspect tasks and focus on issues near their cellphone and watch ecosystem. Had they spent $10 billion extra on AI work then possibly Siri wouldn’t be so horrible with voice to textual content the place I’ve a contact named Gerry and Siri often spells his title as Jerry. There have been quite a few occasions when Siri has gotten confused with easy variations just like the distinction between “there” and “their.”

Valuation

There was an incredible quantity of buyback exercise during the last 10 years. The fiscal 2014 10-Ok exhibits 5,864,840,000 shares excellent as of October 10, 2014 and there was a 4-for-1 break up in 2020 so that is equal to 23,459,360,000 shares. The fiscal 2023 10-Ok exhibits 15,552,752,000 shares excellent as of October 20, 2023. Placing these buybacks in perspective, suppose a wealthy particular person owned 1% of Apple in 2014 which might be the equal of 234,593,600 shares. If that particular person held on over time then that particular person owned greater than 1.5% of Apple by October 2023!

Trailing twelve months (“TTM”) web earnings was $100.9 billion or $33.9 billion + $97 billion – $30 billion on gross sales of $385.7 billion or $119.6 billion + $383.3 billion – $117.2 billion. Given Apple’s glorious monitor report of returning worth to shareholders, I might see it being price 25 to 30x TTM web earnings which is $2.5 to $3 trillion.

Per the 10-Q via December thirtieth, there have been 15,441,881,000 shares excellent as of January 19, 2024. Multiplying by the March 25 share worth of $170.85 provides us a market cap of greater than $2.6 trillion. Per the 1Q24 name, the market cap is comparatively near the enterprise worth:

We ended the quarter with $173 billion in money and marketable securities. We decreased business paper by $4 billion, leaving us with complete debt of $108 billion. In consequence, web money was $65 billion on the finish of the quarter.

The market cap is inside my valuation vary and I believe the inventory is a maintain.

Disclaimer: Any materials on this article shouldn’t be relied on as a proper funding advice. By no means purchase a inventory with out doing your personal thorough analysis.